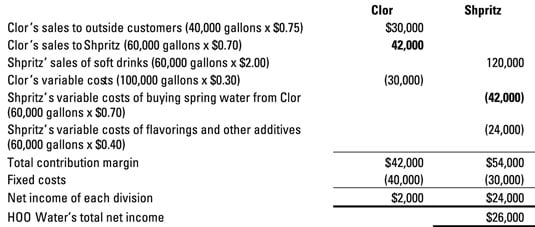

Full cost markup formula transfer pricing

The calculation for setting. First the transfer pricing policy for housing components would change to use variable cost to the components division.

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Further full cost transfer pricing can provide perverse incentives and distort performance measures.

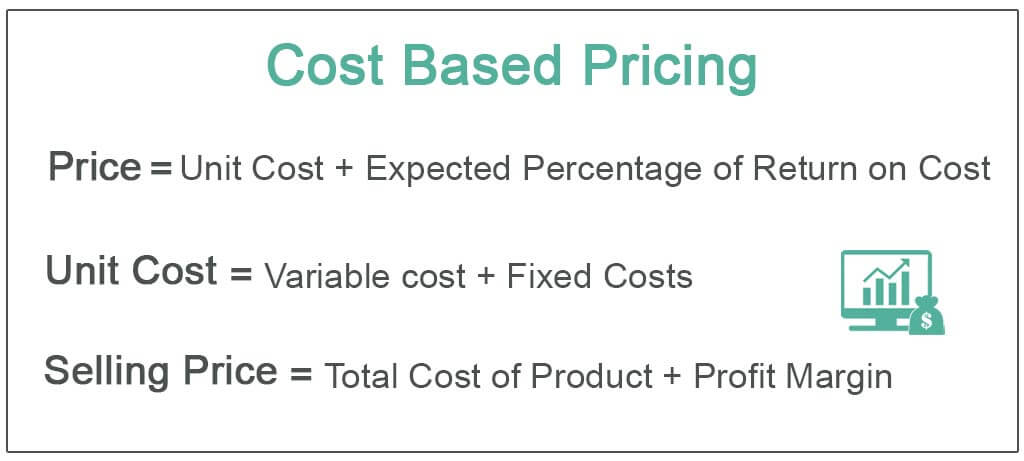

. Full cost plus pricing is a price-setting method under which you add together the direct material cost direct labor cost selling and administrative costs and overhead costs for. The FD wants to know the impact of the change in transfer pricing policy. A full cost transfer price would have shutdown the chances of any negotiation.

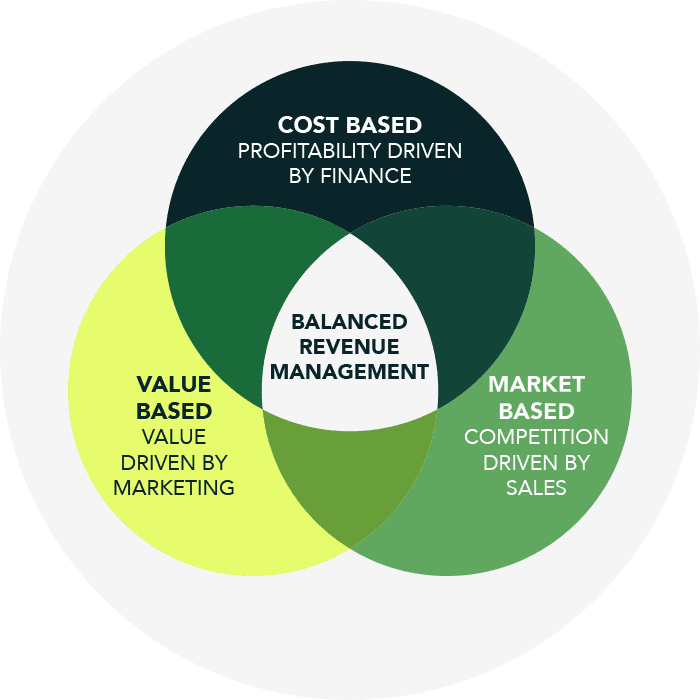

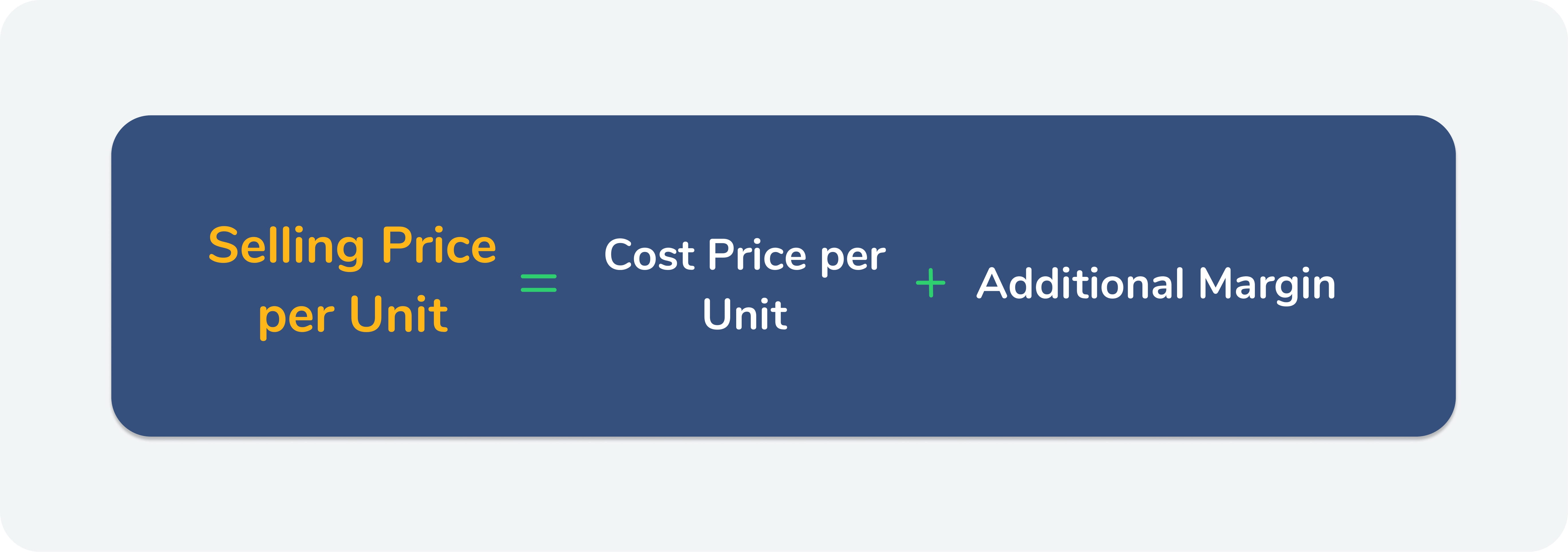

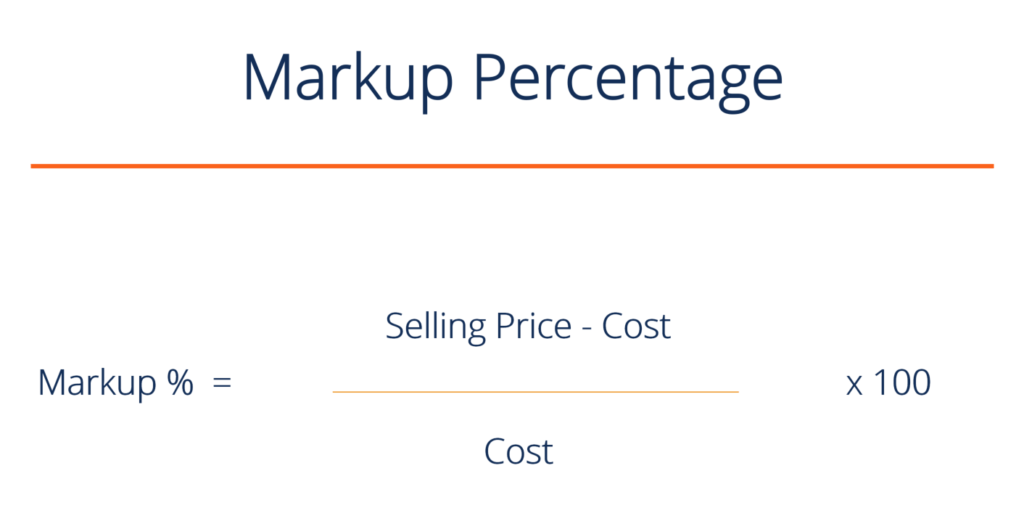

English to Italian translations PRO BusFinancial - Finance general Transfer pricing. This is the most basic and simplest. Cost-plus pricing is a pricing strategy in which the company adds up the profit margin markup to the cost of making the product.

Transfer pricing methods The Cabinet Regulation No. Using this method markup is reflected as a percentage by which initial price is set above product cost as reflected in this formula. The resale price method in transfer pricing is primarily used by distributors to determine an appropriate resale price for tangible goods.

Such transactions are covered by Transfer Pricing and one of the widely used method of measuring the arms length price Cost Plus Method is devised on the same. It looks at comparable transactions and profits of similar. In the article the Resale Price Method with example we look at the details of this transfer pricing method provide a calculation example and indicate when this method should be used.

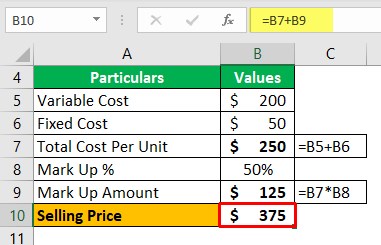

A company may set the transfer price at full cost also known as absorption cost which is the sum of variable and fixed costs per unit. Gross margin is the difference between a products selling price and the cost as a percentage of revenue. To o the price charged for property or services transferred in a.

677 Regulation of the Application of the Provisions of the Corporate Income Tax Act effective from 01012018 lays down the. O the price charged for property or services transferred in a controlled transaction. In order to ensure that the selling division.

For example if a product sells for 125 and costs 100 the gross. The Resale Price Method. The finest fun figures take up 25 percent of their manufacturing floor and 25 percent of their overall sales and administration costs.

Ricarico sul costo pieno Full cost mark-up 0619 May 23 2012. The CUP method compares. The Cost Plus Transfer Pricing Method With Examples The cost plus method is one of the five primary transfer pricing methods.

That means the total production cost.

Negotiated

Pin On How To Get What You Want

Plan De Empresa Para Creativos Tics Y Formacion Plantilla De Plan De Negocios Planificacion Empresarial Ejemplo De Plan De Negocio

Cost Based Transfer Price Youtube

How To Price A Product Free Calculator Formulas Grow Business Business Pricing Calculator

Vx2128v Commercial Desktop Calculator 12 Digit Lcd Total Quantity 1 In 2022 Desktop Calculator Calculator Solar Battery

Insight An Unbiased Approach To Pli Selection In Transfer Pricing Studies

Cost Based Pricing Market Based Pricing Pricing Examples

Cost Based Pricing Definition Formula Top Examples

1

Selling Price Formula And Calculation Wise Formerly Transferwise

1

1

Base Transfer Price On Full Cost Dummies

Cost Based Pricing Definition Formula Top Examples

Markup Calculator Calculate The Markup Formula Examples

Markup Learn How To Calculate Markup Markup Percentage

Komentar

Posting Komentar